itdev-studio.ru Overview

Overview

Opening An Llc For Rental Property

An LLC will help you keep your personal assets separate from your business assets. So if a lawsuit ever stems from your Airbnb or other vacation rental property. If you own rental or other income-producing property, you should consider putting it into a limited liability company. This can be a great way to protect. If you decide to form an LLC for your rental company, your first step is to file articles of organization and begin the process of forming your new company. You. Arguably the most important benefit of forming an LLC is the limited liability protection you receive. With such protection in place, your personal assets —. A more prudent way to own real estate for investment purposes is to transfer ownership to a Limited Liability Company (LLC). Encasing your Pennsylvania rental property in an LLC fortifies your investment with the Keystone of legal protection and financial optimization. Discover the pros and cons of setting up an LLC for rental properties—liability protection, tax advantages and when to consider a trust instead. you would have to transfer the deed and note to the llc otherwise the llc doesn't own the asset or the liability (mortgage) and thus is not. When Should You Form an LLC? · You'll have to tell your renters and revise your rental agreements to reflect the LLC's property ownership. · A title transfer tax. An LLC will help you keep your personal assets separate from your business assets. So if a lawsuit ever stems from your Airbnb or other vacation rental property. If you own rental or other income-producing property, you should consider putting it into a limited liability company. This can be a great way to protect. If you decide to form an LLC for your rental company, your first step is to file articles of organization and begin the process of forming your new company. You. Arguably the most important benefit of forming an LLC is the limited liability protection you receive. With such protection in place, your personal assets —. A more prudent way to own real estate for investment purposes is to transfer ownership to a Limited Liability Company (LLC). Encasing your Pennsylvania rental property in an LLC fortifies your investment with the Keystone of legal protection and financial optimization. Discover the pros and cons of setting up an LLC for rental properties—liability protection, tax advantages and when to consider a trust instead. you would have to transfer the deed and note to the llc otherwise the llc doesn't own the asset or the liability (mortgage) and thus is not. When Should You Form an LLC? · You'll have to tell your renters and revise your rental agreements to reflect the LLC's property ownership. · A title transfer tax.

LLCs are popular business structures for a range of companies. If you are a landlord, here are the top four reasons to form an LLC for rental property. Forming Your LLC · Step 1 Contact your lender. Forming an LLC in California is not prohibitively expensive for most people looking to invest in real estate. The state does currently charge an $ per year. Setting up an LLC for one Rental Property · 1. An LLC is not free. · 2. There are rules to follow! · 3. You do not need a separate LLC for each property or a. Choose an available business name · Fill out the Articles of Organization · Create an LLC Operating Agreement · Obtain any necessary licenses and permits · Register. As a Rental Property Owner, Protect Yourself from Liability With an LLC A limited liability company (LLC) is one of the most common types of business. A limited liability company (LLC) is a legal entity that can operate a business. Real estate investors use LLCs to house their properties. They offer additional. Setting up an LLC for one Rental Property · 1. An LLC is not free. · 2. There are rules to follow! · 3. You do not need a separate LLC for each property or a. Setting up an LLC for rental property is easy to do. To get started, we will email you a list of the information we need to create your new LLC. Information. Owning real estate in an LLC entails separating your rental investment from yourself. This type of ownership can also have tax consequences. Therefore, owning. real estate investment properties in San Diego. An LLC is a legal entity, meaning it can obtain a tax identification number, open a bank account, and do. real estate investment properties in San Diego. An LLC is a legal entity, meaning it can obtain a tax identification number, open a bank account, and do. Again, the key takeaway in forming an LLC for your rental property in California is to have the foreign LLC own the California LLC, and have the California LLC. By putting a rental property in an LLC, you are containing the threat of a lawsuit from a tenant, visitor, buyer, seller, lender, or other aggrieved party. They. Forming Your LLC · Step 1 Contact your lender. Setting up multiple LLCs To start, you'll need to pick a business name for each property. When picking your LLC's name, you may want to use the address. An LLC and a real estate trust are 2 vehicles used to hold investment property but are formed by investors for different purposes. · While both an LLC and a. In this guide, we'll walk you through the essential steps to creating a rental property LLC in Florida so you can enjoy the structure's benefits to the fullest. In the case of rental property, the LLC would be the owner of the rental property in question while you would still derive profitable income from it. Possibly.

How To Open Up A Joint Bank Account

That means Social Security numbers, as well as addresses and birth dates. Click below to get more details on the process: What You'll Need to Open a Checking. Tip: Be sure you truly consider opening up a joint owner account with someone you wouldn't want getting (or taking) the full amount. For business partners. Yes. I did this with Ally -- you first open a new account with an individual owner, and then send in a form (along with copies of identification). Visit your local Santander Bank branch with the person you want to add to your account. Make sure both current account owners and those to be added, bring the. Make sure a joint account is right for you · Weigh up the pros and cons · Set some rules for how you'll use the account · Consider how you'll communicate · Discuss. Genkin says some couples should consider setting up a joint checking account for shared expenses such as the mortgage, groceries and utilities – and. Joint Bank Account · Provide the basics. Answer a few questions on our website or mobile app. · Add a joint account holder. We'll send your partner an application. All our accounts can be opened jointly. Simply select the Joint option when applying. Learn what you'll need to apply online. Opening a joint bank account is similar to setting up individual accounts. Most banks will allow you to sign up online or in person as long as you have the. That means Social Security numbers, as well as addresses and birth dates. Click below to get more details on the process: What You'll Need to Open a Checking. Tip: Be sure you truly consider opening up a joint owner account with someone you wouldn't want getting (or taking) the full amount. For business partners. Yes. I did this with Ally -- you first open a new account with an individual owner, and then send in a form (along with copies of identification). Visit your local Santander Bank branch with the person you want to add to your account. Make sure both current account owners and those to be added, bring the. Make sure a joint account is right for you · Weigh up the pros and cons · Set some rules for how you'll use the account · Consider how you'll communicate · Discuss. Genkin says some couples should consider setting up a joint checking account for shared expenses such as the mortgage, groceries and utilities – and. Joint Bank Account · Provide the basics. Answer a few questions on our website or mobile app. · Add a joint account holder. We'll send your partner an application. All our accounts can be opened jointly. Simply select the Joint option when applying. Learn what you'll need to apply online. Opening a joint bank account is similar to setting up individual accounts. Most banks will allow you to sign up online or in person as long as you have the.

Whether you open your joint account online or in person, you'll likely both need to provide the bank with personal information, including address, date of birth. How do I open a joint account? Once you decide a shared bank account is right for you, add a joint account holder when you open a new bank account or anytime. When you open a joint bank account with someone, your credit histories will be linked. This means your credit score will be affected by theirs – and vice versa. Request to have the account set up so that both parties' signatures are required anytime a withdrawal is made through a teller. This ensures you aren't. You can apply online for a checking account, savings account, CD or IRA. Simply select an account, enter your personal information, verify your information. To change your sole current account to a joint account by adding another person to your account, you'll need to give us a call. Make sure both the existing and. Some questions to kick-start that conversation: What's our plan to tackle our debts? Where will we keep our emergency fund? And how much should we save? How do. Set up a new account which you will both share · The new customer should open a new sole account. · Wait for confirmation via email that the account is ready to. You can apply for a joint bank account online. You will need both party's information. To apply for a joint account, please visit our Checking page and click. The simple answer is no. While it is quite common for married couples to open a joint checking account, you can open one no matter your marital status! Joint. At Huntington, opening a joint bank account can be simple. New account holders can open a joint bank account online or visit a branch (both parties must be. Photo ID. Social Security number. Proof of address. Other general information, such as birth dates. Opening deposit (in some cases). Opening a joint account is as simple as opening up a single account. Both parties should be present at the bank when the account is open—whether that's a. To open a joint bank account or join an existing KeyBank checking or savings account, all account holders need to visit a KeyBank Branch together with a current. You can open a joint bank account online or over the phone — in this case, you'll need the personal information for each account owner, such as their name, date. To open a joint account, you'll need to provide proof of identification and proof of address. Depending on your bank, you may need to provide more than one. Say you and a co-owner then open a joint savings account at Bank X; because When you're ready to set up a Raisin account for the first time, start. What documents do I Need for a Joint Business Bank Account? · EIN · Personal identification · Business license · A certificate with name and date of birth. For some couples, settling on a hybrid approach for money management works best. Each person maintains a separate account while both establish a new joint. If you're under 18, a non-permanent U.S. resident, or if you're applying for a joint account, you'll need to make an appointment to apply in person at a branch.

Snapcab Pod Pricing

Product of interest. Please select Elevator, Pod. Company. First name. Last Please reload page. Reload Page. Features · Pricing · Mobile · Support · Sign. Pricing · Resources · Database Center · Free Tools · Blogs · Knowledge Base · Compare SnapCab offers stand alone quiet spaces (SnapCab Pod), elevator. From a telephone booth for one to a pod seating up to six, SnapCab offers three sizes at a fraction of the cost of conventional construction. SIMPLE TO INSTALL. pods, SnapCab is dedicated to improving the human exper Show more. SnapCab SnapCab does not give cost of living raises or yearly raises per. SnapCab manufactures commercial interior products primarily for office buildings, including privacy pods and phone booths, elevator interiors and ceilings. SnapCab Pod by SnapCab. Dimensions: SnapCab Pod S. Exterior dimensions: 46′′ x 46′′. Exterior height: 91′′. Interior dimensions: 40′′ x 40′′. Interior height. SnapCab Pods provide an experience that supports productivity with quiet ventilation for constant air flow, LED lighting for consistent illumination. SnapCab LinkPro. Category. ACOUSTICS & PRIVACY > Work Pods. Description. SnapCab. SnapCab LinkPro. The Link is a high-quality video conferencing pod. It. SnapCab offers three sizes at a fraction of the cost of conventional construction. SIMPLE TO INSTALL Installation of your pod is fast – think half a day. Product of interest. Please select Elevator, Pod. Company. First name. Last Please reload page. Reload Page. Features · Pricing · Mobile · Support · Sign. Pricing · Resources · Database Center · Free Tools · Blogs · Knowledge Base · Compare SnapCab offers stand alone quiet spaces (SnapCab Pod), elevator. From a telephone booth for one to a pod seating up to six, SnapCab offers three sizes at a fraction of the cost of conventional construction. SIMPLE TO INSTALL. pods, SnapCab is dedicated to improving the human exper Show more. SnapCab SnapCab does not give cost of living raises or yearly raises per. SnapCab manufactures commercial interior products primarily for office buildings, including privacy pods and phone booths, elevator interiors and ceilings. SnapCab Pod by SnapCab. Dimensions: SnapCab Pod S. Exterior dimensions: 46′′ x 46′′. Exterior height: 91′′. Interior dimensions: 40′′ x 40′′. Interior height. SnapCab Pods provide an experience that supports productivity with quiet ventilation for constant air flow, LED lighting for consistent illumination. SnapCab LinkPro. Category. ACOUSTICS & PRIVACY > Work Pods. Description. SnapCab. SnapCab LinkPro. The Link is a high-quality video conferencing pod. It. SnapCab offers three sizes at a fraction of the cost of conventional construction. SIMPLE TO INSTALL Installation of your pod is fast – think half a day.

$ ; Shipping: No ; Online Payment: Yes ; Lot Description: Snapcab Pod. This is a portable, rolling, sound resistant phone booth. The 3 outside panels are. pods, SnapCab is dedicated to improving the human exper Show more. SnapCab Avoid working here at all costs. As a production technician they lure. Pricing. Sign Up. Contact Sales Log In. search icon Search. search icon Search CHICAGO, Ill., Oct. 21, /PRNewswire/ - Office pod manufacturer SnapCab. Baseline GHG Emissions: Measurement in progress. ABOUT THE MEMBER: Since , SnapCab has been a leader in developing elevator and pod products. SnapCab. These booths are perfect for the contemporary office and make great private spaces for focused work. You can take advantage of affordable prices in a wide range. Several Corning facilities in the US are featuring SnapCab® Pod office spaces of the future and SnapCab® Portal collaboration spaces featuring Corning® Gorilla. Congratulations to School of Human Ecology student, Gia Kieu, for winning the SnapCab 3rd Annual Pod Design Contest! T ". By Michelle RoseKINGSTON, ON, June 7, /PRNewswire/ - The winning pod design for SnapCab's first annual 'Space To Be You' contest will be reve. an orangebox 3-person pod, and a snapcab phone booth pod 2. Add some If all else fails, consider demountable walls – as cost-effective, less disruptive. SnapCab Pods from Steelcase are stand-alone office pods that are simple to price, combining design freedom with incredibly fast installation to. Providing choice and control in a space for people, the IRYS pod SnapCab Pods are an easy way to create private stand-alone spaces that offer. SnapCab offers stand alone quiet spaces (SnapCab Pod), elevator interiors Cost Estimator jobs · Director of Engineering jobs · Quality Assurance. “We quickly realized we had the design and manufacturing capabilities to develop medical testing pods for use by healthcare workers,” Bostock said. “We started. SnapCab designs and installs interior elevator paneling systems. It provides elevator interior with modular systems, stand alone office pods. lead times (not to mention better price points). Each client gets a All of SnapCab's Workspace pod products have corners that are designed to. Download the catalogue and request prices of Vetrocube s By vetrospace, acoustic multimedia office booth Distraction-Free Pods for Open Workspaces - SnapCab. SnapCab: Space to be You. SnapCab's pod systems empower designers by giving them back control with unlocked designs. Every workspace is unique, and ensuring. Real Estate & Construction - Private · Compare competitors. News. Office Pod Manufacturer SnapCab Looks Toward Expansion Share price data provided by IEX. SnapCab LinkPro. Category. ACOUSTICS & PRIVACY > Work Pods. Description. SnapCab. SnapCab LinkPro. The Link is a high-quality video conferencing pod. It. Office Pods, Snapcab, Snap Cap Booth, Snapcab Cost, Room Phone Booth Snapcab. Competitors, Columbia Elevator Products Co., Inc, Elkay Interior Systems.

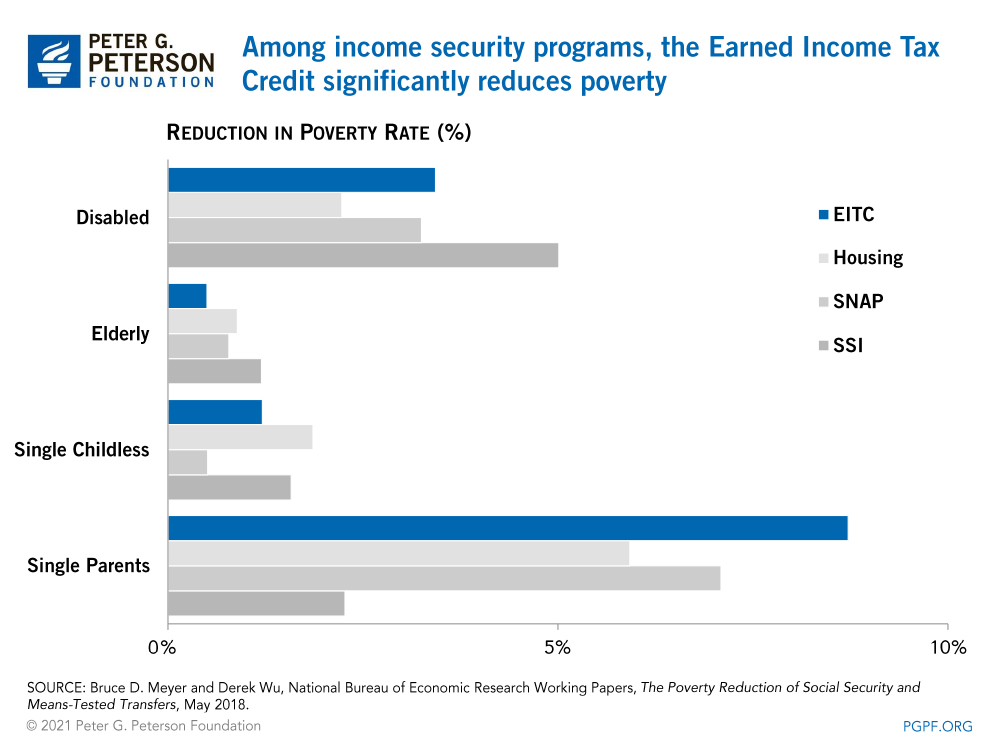

Eitc For Single Person

with an Individual Taxpayer Identification Number (ITIN), or · without a qualifying child and is at least age 18 or older (including taxpayers over ages 65). It's free money from the federal government. The IRS administers the EITC, but you don't have to owe or pay any federal income taxes to qualify for it. However. You can claim the credit whether you're single or married, or have children or not. The main requirement is that you must earn money from a job. The credit can. The Earned Income Tax Credit or the EITC is a refundable federal income tax credit for low to moderate income working individuals and families. Congress. If you qualify for the EITC, you can still receive a tax refund even if you don't owe income tax. You can claim the credit whether you're single or married, or. Earned income is money received as pay for work performed, such as wages, salaries, bonuses, commissions, tips, and net earnings from self-employment. If you have no children, you must be between the ages of 25 and If you are: Single, you must earn less than $17,; Married, you must file jointly and. Your qualifying child for the EITC cannot be used by more than one person to claim the EITC. AGI Must be Less Than for Filing Status: Single, Head of. If you are married, you and your spouse both need to qualify to get the EITC. A child can only be claimed by one person or a married couple filing jointly. with an Individual Taxpayer Identification Number (ITIN), or · without a qualifying child and is at least age 18 or older (including taxpayers over ages 65). It's free money from the federal government. The IRS administers the EITC, but you don't have to owe or pay any federal income taxes to qualify for it. However. You can claim the credit whether you're single or married, or have children or not. The main requirement is that you must earn money from a job. The credit can. The Earned Income Tax Credit or the EITC is a refundable federal income tax credit for low to moderate income working individuals and families. Congress. If you qualify for the EITC, you can still receive a tax refund even if you don't owe income tax. You can claim the credit whether you're single or married, or. Earned income is money received as pay for work performed, such as wages, salaries, bonuses, commissions, tips, and net earnings from self-employment. If you have no children, you must be between the ages of 25 and If you are: Single, you must earn less than $17,; Married, you must file jointly and. Your qualifying child for the EITC cannot be used by more than one person to claim the EITC. AGI Must be Less Than for Filing Status: Single, Head of. If you are married, you and your spouse both need to qualify to get the EITC. A child can only be claimed by one person or a married couple filing jointly.

To claim the EITC, workers with children must file either form or A and submit the Schedule EIC. Workers without children can file any tax form. The EITC Assistant, available in English and Spanish, helps users determine if they are eligible and if they have a qualifying child or children, and it. Because the EITC is a refundable credit, a person who qualifies for this Individual Income Tax Service Center · itdev-studio.ru Information · Real. Workers without children can only use the EITC if they are between age 25 and 65, and are not the dependent of another person. Who counts as a “child” for the. You can claim the Earned Income Credit on your individual tax return on Form You should include Schedule EIC if you have dependent qualifying children. 5. Earned Income Tax Credit ; Earned Income Amount. $10, $14, ; Maximum Amount of Credit. $3, $5, ; Threshold Phaseout Amount (Single, Surviving. Eligible to claim the federal Earned Income Tax Credit (EITC) on their tax return (or would meet the requirements for EITC but are filing with an ITIN). $ Have investment income below $ Have a valid Social Security number (SSN) or IRS-issued Individual Taxpayer Identification Number (ITIN). How does the Earned Income Credit apply to heads of household? ; Single, Head of Household, and Qualifying Widow(er), Income Limit ; No children, $21, ; One. $53, if you have three or more qualifying children ($59, if married filing jointly) " Only that person, if otherwise eligible, can claim the EIC for. The Earned Income Tax Credit is a federal and state tax credit for people making up to $ a year and can give families up to $ back when they file. Exception: For Wisconsin, a married individual filing as married filing separate cannot claim the earned income tax credit. Only a married individual that. Low-income adults with no children are eligible. For a person or couple to claim one or more persons as their qualifying child, requirements such as. Married filing jointly; Head of household; Qualifying widow(er); Single. You can't claim EITC if your filing status is “married filing separately”. If you work and your family made less than $63, in , you may qualify for EITC. The credit amount you receive depends on your marital status, the amount. You must file, even if you do not owe tax or are otherwise not required to file. You must claim the federal EITC. AND file the Michigan individual income Tax. Taxpayers who filed a federal income tax return using a federal individual taxpayer identification number (ITIN) issued by the Internal Revenue Service, or who. Pennsylvania businesses can begin applying for EITC credits through DCED's electronic single application system. DCED will no longer require applicants to. Individual Income Tax Filing Open submenu; Estates, Trusts, and the Deceased Eligible exemptions include personal exemptions only. You may not claim. Starting with tax year , this credit may be available if you, your spouse, or your dependents have an Individual Taxpayer Identification Number (ITIN) or a.

What Bank Is Used For Cash App

Cash App is not a traditional bank, but it partners with Lincoln Savings Bank, a member of the Federal Deposit Insurance Corporation (FDIC). If the Cash App Pay payment used the customer's linked debit card as the Every Cash App Pay payment appears on the customer's bank statement with the CashApp*. Cash App outsources basic banking functions to two FDIC-insured partner banks, Sutton Bank and Lincoln Savings Bank. Sutton Bank Cash App provides Prepaid Debit. Cash App Pay is currently available for businesses processing payments on Square Register, Square Stand, and Square Terminal, as well as Square Point of Sale. Some services charge yet another fee when you want to transfer received money to your bank account. Cash App charges % to % fee for instant deposits . 3M Followers, 2 Following, Posts - Cash App (@cashapp) on Instagram: "$ send $ spend $ bank $ invest $ Prepaid debit cards issued by Sutton Bank. Cash App is not a traditional bank, but it partners with Lincoln Savings Bank, a member of the Federal Deposit Insurance Corporation (FDIC), to. If the Cash App Pay payment used the customer's linked debit card as the Every Cash App Pay payment appears on the customer's bank statement with the CashApp*. However, Cash App does offer basic financial services through two FDIC-insured bank partners: Sutton Bank and Wells Fargo. Sutton Bank administers the Cash Card. Cash App is not a traditional bank, but it partners with Lincoln Savings Bank, a member of the Federal Deposit Insurance Corporation (FDIC). If the Cash App Pay payment used the customer's linked debit card as the Every Cash App Pay payment appears on the customer's bank statement with the CashApp*. Cash App outsources basic banking functions to two FDIC-insured partner banks, Sutton Bank and Lincoln Savings Bank. Sutton Bank Cash App provides Prepaid Debit. Cash App Pay is currently available for businesses processing payments on Square Register, Square Stand, and Square Terminal, as well as Square Point of Sale. Some services charge yet another fee when you want to transfer received money to your bank account. Cash App charges % to % fee for instant deposits . 3M Followers, 2 Following, Posts - Cash App (@cashapp) on Instagram: "$ send $ spend $ bank $ invest $ Prepaid debit cards issued by Sutton Bank. Cash App is not a traditional bank, but it partners with Lincoln Savings Bank, a member of the Federal Deposit Insurance Corporation (FDIC), to. If the Cash App Pay payment used the customer's linked debit card as the Every Cash App Pay payment appears on the customer's bank statement with the CashApp*. However, Cash App does offer basic financial services through two FDIC-insured bank partners: Sutton Bank and Wells Fargo. Sutton Bank administers the Cash Card.

' - the simple answer is that it can be used online and in stores. How do To withdraw money from your Cash App balance to your bank account, simply. Cash App is a financial platform, not a bank. Banking services provided by Cash App's bank partner(s). Debit cards issued by Sutton Bank, pursuant to a. So Cash App is a bank, a brokerage account, a money transfer app, and a coupon service, all in one. If you need to send money to just about any member of the. Janeiro Starks had safely used the Cash App platform for three years, but ✓ Take action: If you've been the victim of a Cash App scam, your bank account. Cash App partners with banks like Sutton Bank and Lincoln Savings Bank to offer financial services, including prepaid debit cards and mobile banking. CASH APP (SQUARE) · SQUARE CHECKING · Robinhood · Albert · Vanilla Gift: · Providers Card · GA Gateway Cash Cards. Cash App is the easy way to send, spend, save, and invest* your money. Download Cash App and create an account in minutes. SEND AND RECEIVE MONEY INSTANTLY. What is Cash App? Cash App started in as a payment app for sending and receiving money. It was created by Square, Inc. (now called Block, Inc.), the tech. used cash apps more since the beginning of the pandemic. And even though you Zelle can be downloaded as a stand-alone app or as part of a participating bank. *Cash App is a financial services platform, not a bank. Banking services and FDIC Insurance provided by Cash App's bank partner(s). With a Cash App Card. Cash App uses Lincoln Savings Bank as its main bank to connect with Plaid. Plaid is a financial technology company that provides APIs that allow apps and. You can transfer funds from your Cash App balance out to your bank account. These transfers can take up to three days, or for a fee, be made instantly. We may. Tap the Money tab on your Cash App home screen · Provide the account and routing number when prompted for a bank account during direct deposit setup. To view. One of the great features of Cash App is that it comes with a debit card. Your Cash App card can be used both online and in stores, and you can use it with. Cash App 4+. P2P. Banking. Bitcoin. Stocks. Block, Inc. #1 in Finance. And because it's a digital card that lives in Wallet, your Apple Cash can be spent in stores, online, and in apps with Apple Pay. You can even set up your kids. Tap the Money tab on your Cash App home screen · Provide the account and routing number when prompted for a bank account during direct deposit setup. To view. Cash App supports debit and credit cards from Visa, MasterCard, American Express, and Discover. Most prepaid cards are also supported. Send money to friends and family no matter where they bank in the U.S., using the Bank of America Mobile Banking app with Zelle Forget Cash & Checks.

What Are Oil Futures

An oil futures contract is an agreement to buy or sell a certain number of barrels of oil at a predetermined price, on a predetermined date. When futures are. CL.1 | View the latest Crude Oil WTI (NYM $/bbl) Front Month Contracts and compare Futures prices with WSJ. Crude oil futures, E-mini crude oil futures and Micro WTI crude oil futures can be traded nearly 24 hours a day, five days a week on the thinkorswim® trading. That axiom may never be more relevant than it is in futures trading, specifically the crude oil markets. Led by the industry benchmark West Texas Intermediate . The current price of Light Crude Oil Futures is USD / BLL — it has risen % in the past 24 hours. Watch Light Crude Oil Futures price in more detail on. Oil futures are an agreement to buy or sell an exact amount of oil for a set price at a set date in the future. This type of contract trading is commonly seen. Oil futures are contracts in which you agree to exchange an amount of oil at a set price on a set date. They're traded on exchanges and reflect the demand for. The current price of West Texas Intermediate (WTI) crude oil today is $ per barrel. Live charts, historical data, futures contracts, and breaking news. One of the roles of futures markets is price discovery, and as such, these markets play a role in influencing oil prices. Oil market trading activity involves a. An oil futures contract is an agreement to buy or sell a certain number of barrels of oil at a predetermined price, on a predetermined date. When futures are. CL.1 | View the latest Crude Oil WTI (NYM $/bbl) Front Month Contracts and compare Futures prices with WSJ. Crude oil futures, E-mini crude oil futures and Micro WTI crude oil futures can be traded nearly 24 hours a day, five days a week on the thinkorswim® trading. That axiom may never be more relevant than it is in futures trading, specifically the crude oil markets. Led by the industry benchmark West Texas Intermediate . The current price of Light Crude Oil Futures is USD / BLL — it has risen % in the past 24 hours. Watch Light Crude Oil Futures price in more detail on. Oil futures are an agreement to buy or sell an exact amount of oil for a set price at a set date in the future. This type of contract trading is commonly seen. Oil futures are contracts in which you agree to exchange an amount of oil at a set price on a set date. They're traded on exchanges and reflect the demand for. The current price of West Texas Intermediate (WTI) crude oil today is $ per barrel. Live charts, historical data, futures contracts, and breaking news. One of the roles of futures markets is price discovery, and as such, these markets play a role in influencing oil prices. Oil market trading activity involves a.

Explore real-time Crude Oil futures price data and key metrics crucial for understanding and navigating the Crude Oil Futures market. The WTI Crude Oil futures contract trades in $ price increments. As each contract is equal to 1, barrels of oil, a $ price move equates to $ ($. Heating Oil futures are a cash settled futures contract that are unique in the fact that they appeal to both physical and financial traders. Heating oil is. As the most liquid and leading platform for trading global crude and refined oil markets, ICE provides hundreds of oil futures and options contracts. WTI Crude Oil futures and options are the most efficient way to trade the largest light, sweet crude oil blend. Today's Crude Oil WTI prices with latest Crude Oil WTI charts, news and Crude Oil WTI futures quotes. For instance, if you want to trade in Rs 50 lakh worth, you only have to deposit Rs lakh in margins. Plus, the crude oil market is also very liquid (in. CL.1 | A complete Crude Oil WTI (NYM $/bbl) Front Month futures overview by MarketWatch. View the futures and commodity market news, futures pricing and. The price of oil, or the oil price, generally refers to the spot price · The global price of crude oil was relatively consistent in the nineteenth century and. Crude oil futures are the benchmark for oil prices in the United States and serve as a reference point for global oil pricing. Crude oil is classified as light. Crude oil futures contracts are the most actively traded physical commodity on the futures market due to public consumption and necessity of crude oil. The two popular crude oil ETFs are the United States 12 Month Oil Fund (USL) and the United States Oil Fund (USO). Both ETFs are issued by the United States. A futures contract specifying the earliest delivery date. For gasoline, heating oil, and propane each contract expires on the last business day of the month. An oil futures contract is the agreement to buy and sell a particular amount of barrels of oil at a predetermined rate on a pre-decided date. When futures are. Crude Oil Futures and Options: Open outcry trading is conducted from A.M. until P.M.. After hours crude oil futures trading are conducted via the. Trading crude oil futures allows traders to speculate on the price movement of one of the world's most active commodities. Learn more from NinjaTrader. Tradovate, LLC is an NFA registered introducing broker providing brokerage services to traders of futures exchange products. Tradovate, LLC does not charge a. by Dan Lothrop, Northland Energy Trading What determines oil futures prices? We all know that prices are determined by supply and demand (Economics ), so. Oil & Gas Producer Hedging with Futures. So how can an oil and gas producer utilize futures contracts to hedge their exposure to volatile oil and gas prices? As. Futures and options on crude oil trade at the CME Group and at the ICE The CME trades two main types of crude oil: light sweet crude oil and Brent crude oil.

Cheapest Auto Insurance In Ct

GEICO's tailored car insurance plans offer the protection you need. Get a personalized car insurance quote today to see how GEICO can help you save. State Farm, GEICO, and USAA have the cheapest car insurance in New Haven. The Connecticut Department of Insurance recommends buying comprehensive coverage to. Geico stands out as Connecticut's most affordable car insurance provider, offering an average monthly rate of $66, which is notably lower than competitors like. Auto insurance companies in CT charge around $ per month or $4, annually on average. However, many factors are used to calculate your premiums. Every. What does car insurance cover? Most auto insurance policies include liability coverage, which helps cover someone else's bodily injury or property damages when. The cheapest insurance company for good drivers in Connecticut is Travelers with an average monthly rate of $ Cheapest Car Insurance for Good Drivers . Electric and Kemper have the overall cheapest car insurance in Connecticut for good drivers, based on the companies in our analysis. The Cheapest Car Insurance. Are you looking for cheap car insurance in Hartford, Connecticut? Freeway Insurance provides you options for affordable coverage, plus ways to save. Get a free Connecticut car insurance quote today. Nationwide offers personalized coverage options, discounts, and auto insurance you can rely on. GEICO's tailored car insurance plans offer the protection you need. Get a personalized car insurance quote today to see how GEICO can help you save. State Farm, GEICO, and USAA have the cheapest car insurance in New Haven. The Connecticut Department of Insurance recommends buying comprehensive coverage to. Geico stands out as Connecticut's most affordable car insurance provider, offering an average monthly rate of $66, which is notably lower than competitors like. Auto insurance companies in CT charge around $ per month or $4, annually on average. However, many factors are used to calculate your premiums. Every. What does car insurance cover? Most auto insurance policies include liability coverage, which helps cover someone else's bodily injury or property damages when. The cheapest insurance company for good drivers in Connecticut is Travelers with an average monthly rate of $ Cheapest Car Insurance for Good Drivers . Electric and Kemper have the overall cheapest car insurance in Connecticut for good drivers, based on the companies in our analysis. The Cheapest Car Insurance. Are you looking for cheap car insurance in Hartford, Connecticut? Freeway Insurance provides you options for affordable coverage, plus ways to save. Get a free Connecticut car insurance quote today. Nationwide offers personalized coverage options, discounts, and auto insurance you can rely on.

The cheapest car insurance in Connecticut comes from GEICO at $51 per month on average. The average car insurance cost in CT is $2, for full coverage and $ for minimum coverage per year. Find quotes for your area. The state minimum coverage in Connecticut is $25, for each person, $50, per accident for injuries, and $25, per accident for damage to vehicles or. Choosing car insurance in Middletown, CT is hard enough with the many insurance providers available, but Wirefly makes the process much easier. Instead of going. In Connecticut, an average full coverage car insurance policy costs around $ for six months of coverage. GEICO offers the lowest rates at $ per month. Connecticut Auto Insurance Laws and Requirements · Bodily injury liability coverage: $25, per person and $50, per accident · Property damage liability. Learn about the average cost of car insurance in Connecticut by coverage level, deductible, and other factors so you make smart decisions about your car. Fair car insurance in Connecticut. Root offers affordable, high quality auto insurance to safe drivers in Connecticut. From Stamford to New Haven and Norwalk to. How to find the cheapest car insurance quotes in Connecticut ; Progressive. $ Randall, Stamford, CT ; Nationwide. $ Nicholas, East Hartford, CT. Connecticut drivers save an average of over $ on auto insurance. How much could you save with NJM? Learn about Connecticut car insurance from Plymouth Rock Assurance. Get CT car insurance quotes, review discounts or compare rates. Connecticut drivers can get a free car insurance quote in just a few clicks. Learn about state-required coverages & available discounts from Allstate. GEICO offers the cheapest minimum coverage auto insurance in Connecticut, with an average annual premium of $ Enter your ZIP code to get started. We have curated a list of all the best car insurance companies in Connecticut that provides affordable policies to the drivers of this category. To help you find the cheapest car insurance in Connecticut WalletHub collected quotes from all major auto insurers in Connecticut. Discover affordable Connecticut car insurance from The General. Start your Connecticut auto insurance quote and receive a free estimate today. According to our data, USAA generally has the most affordable car insurance in Waterbury coming in around $ per month. Other companies to consider if you. Based on itdev-studio.ru's data analysis, Geico has the cheapest car insurance premiums in Hartford, CT, for an average annual cost of $1, Last updated: Mar. State Farm offers the cheapest liability car insurance in Connecticut, with a monthly rate of $ GEICO has the second-cheapest car insurance option, at $ State Farm is Connecticut's cheapest full coverage auto insurance, with an average annual rate 44% lower than the state average.

Why Did Health Insurance Go Up

Why did my health insurance premium go up? I have not been ill or filed any claims with my insurance company. Even though you have not filed any claims. Insurance coverage for preventive care increased men's receipt of preventive services more than it did that of women. Men with no coverage for preventive. One of the changes that was outlined in Obamacare was a provision for a percentage of premiums for actual health. In addition, the pre-existing. Medical expenses, such as hospital stays and prescription drugs, continue to increase, resulting in higher health insurance premiums. Lastly, inflation. Your rates will be higher if you buy additional coverage or protection. If you drive an older vehicle, and decide not to purchase collision and comprehensive. The medical cost trend is defined as the projected percentage increase in the cost to treat patients from one year to the next, assuming benefits remain the. A time outside the yearly Open Enrollment Period when you can sign up for health insurance. after these new savings will go down. How to find out if. Health insurance premiums are based on factors such as your age, sex Why did my insurance premium increase? Sometimes your premium will increase. The ACA made premium tax credits available to people purchasing health coverage on the marketplaces but only when their incomes fell between % and % of. Why did my health insurance premium go up? I have not been ill or filed any claims with my insurance company. Even though you have not filed any claims. Insurance coverage for preventive care increased men's receipt of preventive services more than it did that of women. Men with no coverage for preventive. One of the changes that was outlined in Obamacare was a provision for a percentage of premiums for actual health. In addition, the pre-existing. Medical expenses, such as hospital stays and prescription drugs, continue to increase, resulting in higher health insurance premiums. Lastly, inflation. Your rates will be higher if you buy additional coverage or protection. If you drive an older vehicle, and decide not to purchase collision and comprehensive. The medical cost trend is defined as the projected percentage increase in the cost to treat patients from one year to the next, assuming benefits remain the. A time outside the yearly Open Enrollment Period when you can sign up for health insurance. after these new savings will go down. How to find out if. Health insurance premiums are based on factors such as your age, sex Why did my insurance premium increase? Sometimes your premium will increase. The ACA made premium tax credits available to people purchasing health coverage on the marketplaces but only when their incomes fell between % and % of.

Health Alliance has requested a new rate increase effective Jan. 1, for their small group ACA plans with, an average of % increase. go up or down: Costs may be lower if. You're younger; You have fewer health Did you know there are a number of ways to easily save on your health. Notably, the average deductible for employees is going up. This increase is the result of both higher deductible requirements within plans and increased. Did your home insurance premiums go up a little more than they normally do? There is an explanation. Rate Review helps protect you from unreasonable rate increases. Insurance companies must now publicly explain any rate increase of 15% or more before raising. The industry itself is set at the mercy of economic conditions, regulation changes, and medical technology advances. All these factors could cause insurers to. The reasons and processes behind premium increases, and your options if you're considering changing your health insurance policy. · Reasons for Premium. When your income changes, so does your premium tax credit · If your income goes up or you lose a member of your household: You'll probably qualify for a lower. If your income goes up, your monthly premium may go up. You will not pay more than % of your annual income on health insurance premiums. Do I have to enroll. Over the same period, the CPI for medical care increased by percent, an average annual increase of percent. The CPI total-premium index increased more. there are many reasons for health insurance premiums to increase this fiscal.. Covid claims have taken a toll on insurers Wallets on the other. year increase For Americans without insurance coverage, the rising cost of health care can be even more damaging. Patients who can't afford to pay out of. Cutler explored three driving forces behind high health care costs—administrative expenses, corporate greed and price gouging, and higher utilization of costly. The following table depicts the final overall weighted average premium increase for the merged (individual and small employer) market filed by insurance. Covered CA: average rate increase for individual market products = %. Public Meeting Regarding Prescription Drug Prices and Large Group Health Insurance. Why did my health insurance premium go up? I have not been ill or filed any claims with my insurance company. Even though you have not filed any claims. Total yearly costs include: Monthly premium x 12 months: The amount you pay to your plan each month to have health insurance. Deductibles: How much you'. When you get coverage, it also includes things like seeing a doctor for a check-up, going to the hospital, seeing a counselor or therapist, paying for. Since , incomes have barely kept up with inflation and insurance premiums have more than doubled. The average employer family health plan that cost. Health insurance premiums are based on factors such as your age, sex Why did my insurance premium increase? Sometimes your premium will increase.

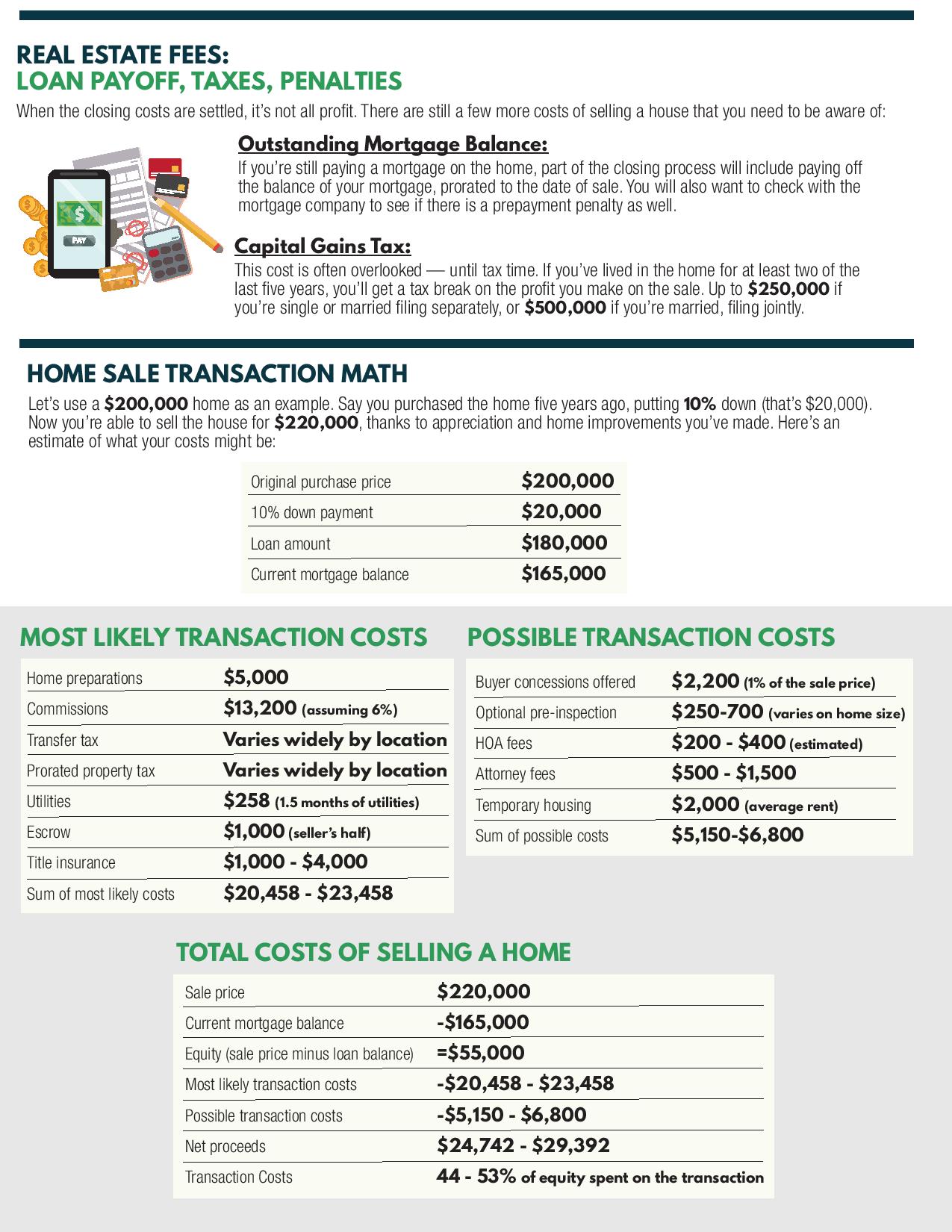

What Are The Sellers Costs When Selling A Home

Seller closing costs. Sellers often pay 1% to 3% of the total sale price of the home in closing costs, which can cover: Prorated property taxes and HOA fees. The short answer is that it's all negotiable. Trends and customs can vary depending on the current state of the real estate market. In some cases, the seller. Combined NYC and NYS Transfer Taxes for sellers in New York City is between % and % of the sale price. Both NYC and New York State charge a separate. The following calculator makes it easy to quickly estimate the closing costs associated with selling a home & the associated net proceeds. As an estimate, you can expect to pay between 3%-7% of the price of your home in REALTOR® fees. In Canada, generally the seller pays the commission to both the. See the Buyers Guide or Sellers Guide for more details about the process of each buying or selling a home in Saskatoon. Search. Recent Posts. # 10% is more accurate. Also, if your house will sell for more than k, try to negotiate 4%. 6% is a lot for commission. Closing costs often run between 2% and 5% of the purchase price of the house. Typically, these costs are paid by the buyer not the seller. *“Other” Closing Costs* · Termite Inspection · Home Warranty · Seller Concessions · Unpaid Bills Related to Selling Your House. Seller closing costs. Sellers often pay 1% to 3% of the total sale price of the home in closing costs, which can cover: Prorated property taxes and HOA fees. The short answer is that it's all negotiable. Trends and customs can vary depending on the current state of the real estate market. In some cases, the seller. Combined NYC and NYS Transfer Taxes for sellers in New York City is between % and % of the sale price. Both NYC and New York State charge a separate. The following calculator makes it easy to quickly estimate the closing costs associated with selling a home & the associated net proceeds. As an estimate, you can expect to pay between 3%-7% of the price of your home in REALTOR® fees. In Canada, generally the seller pays the commission to both the. See the Buyers Guide or Sellers Guide for more details about the process of each buying or selling a home in Saskatoon. Search. Recent Posts. # 10% is more accurate. Also, if your house will sell for more than k, try to negotiate 4%. 6% is a lot for commission. Closing costs often run between 2% and 5% of the purchase price of the house. Typically, these costs are paid by the buyer not the seller. *“Other” Closing Costs* · Termite Inspection · Home Warranty · Seller Concessions · Unpaid Bills Related to Selling Your House.

Seller closing costs. Sellers often pay 1% to 3% of the total sale price of the home in closing costs, which can cover: Prorated property taxes and HOA fees. The average closing cost in Alberta is estimated at 1% - % of the home's purchase price. These closing costs in Alberta include legal fees, land transfer. The seller's main responsibility for closing costs is paying the real estate agent's commission. Sellers pay a few more miscellaneous closing costs as well. The seller pays for half of the escrow closing cost. In addition to paying for title insurance, the seller typically pays for half of the escrow cost and the. The cost of selling a house varies, but sellers can expect to pay between 10% and 15% of the home's sale price. In Virginia, seller closing costs generally range from 7% to 9% of the sale price, depending greatly on the situation. *“Other” Closing Costs* · Termite Inspection · Home Warranty · Seller Concessions · Unpaid Bills Related to Selling Your House. This may not sound like a lot, but it can certainly add up, especially if you end up selling your property for a lot of money. Keep in mind that the price of a. The same concept still applies to the sale of Massachusetts real estate. At the time of the sale of a home, the seller is required to be a tax to the. Real estate agent fees In a traditional home sale, the seller pays fees to both their agent and the buyer's agent. It's common for the total commission to. Closing costs often run between 2% and 5% of the purchase price of the house. Typically, these costs are paid by the buyer not the seller. The closing cost typically range between 1 – 2% of the sale price and these seller closing cost are paid at the settlement. Buying a home is expensive, but sellers can also face several costs. Costs of selling a home can include commissions and fees such as filing fees or notary. In place of Land Transfer tax as a buyer, sellers pay the commissions on the purchase price. Ideally, the buyers deposit covers these total costs, but not. Sellers' costs associated with selling their homes typically range from %. The expertise you show and the advice you provide on how to handle these costs. Sellers usually pay both their listing agent's commission and the buyer agent's commission charges, generally % of the home sale price per agent. Agent. What Fees Do Sellers Pay When Selling a House? ; Title Insurance Fee, % to % of the final sale price ; Escrow Fees, $ to $3, ; Seller's Attorney Fee. Closing costs are a blanket term for the various fees and expenses (not including realtor commission) both buyers and sellers pay at the close of a real estate. Real Estate Commissions are typically a percentage of the sale price but it could be a flat fee as well. So if you sold your house for $, at a 5%.

Website For Scholarships And Grants

Scholarships and Grants Scholarships and Grants. You can apply for State of Kansas Student Aid one of two ways: 1. Complete the online form to apply for the. Find unique college scholarships, grants, internships, college tips and more — % FREE. This website uses cookies to enhance user experience and to. Scholly helps students like you win life-changing scholarships. Start matching with scholarships based on your unique background and accomplishments! Thank you for your patience. Close. Search our website: X. Academics · Find Your Scholarships and grants are awards that do not need to be repaid and. We compiled this list of the best websites for scholarships to help you find the best funding opportunities for your education. Information on all the scholarships and grants LOSFA provides can be found here as well as the requirements for each. Prepare for your education with LOSFA. Looking for scholarships? You can search more than scholarships, fellowships, grants, and other financial aid award opportunities. Scholarships and grants can come from government sources or from private sources (such as colleges and universities, nonprofit foundations and religious or. College scholarships are financial aid for college that you can apply for through organizations, websites, scholarship tools, and more. Scholarships can be. Scholarships and Grants Scholarships and Grants. You can apply for State of Kansas Student Aid one of two ways: 1. Complete the online form to apply for the. Find unique college scholarships, grants, internships, college tips and more — % FREE. This website uses cookies to enhance user experience and to. Scholly helps students like you win life-changing scholarships. Start matching with scholarships based on your unique background and accomplishments! Thank you for your patience. Close. Search our website: X. Academics · Find Your Scholarships and grants are awards that do not need to be repaid and. We compiled this list of the best websites for scholarships to help you find the best funding opportunities for your education. Information on all the scholarships and grants LOSFA provides can be found here as well as the requirements for each. Prepare for your education with LOSFA. Looking for scholarships? You can search more than scholarships, fellowships, grants, and other financial aid award opportunities. Scholarships and grants can come from government sources or from private sources (such as colleges and universities, nonprofit foundations and religious or. College scholarships are financial aid for college that you can apply for through organizations, websites, scholarship tools, and more. Scholarships can be.

The EURAXESS website shares information about funding schemes across Europe for research posts, fellowships and doctoral studies. Discover the EURAXESS national. The U.S. Department of Education offers several federal grants to help with higher education costs. To qualify for federal financial aid, students must meet all. Apply to exclusive scholarships and grants in minutes. At itdev-studio.ru you may search from a list of scholarships for college students, high school students. Find College Scholarships · $ 25, "Be Bold" No-Essay Scholarship. Deadline · $ 2, Sallie Mae No Essay Scholarship. Deadline · $ 50, ScholarshipOwl No. Enter your information to find matches from over 24, programs, totaling over $ billion scholarship dollars yearly. State and Federal Grants and Scholarships provide financial aid that does not have to be repaid. Federal PELL Grant (redirect to federal website). There are tons of scholarships out there, designed to help students like you get to—and stay in—college. Start exploring and start the application process. scholarship and the scholarship page on CollegeBoard are also reliable. within these sites, just scroll until you see scholarships that you. The best way to find scholarships or internships is to use a personalized search, like Fastweb, that compares your student profile with a database of awards. Link to share · UTI Natural Disaster Grant · Georgia Securities Association Scholarship · T.E. Patterson Memorial Undergraduate Scholarship · Orange County WTS. ScholarshipPortal is the best scholarship website for international students looking to meet their financial needs. Browse comprehensive scholarship lists. Find scholarships, internships, and college information with Fastweb - the largest scholarship database for high school, college, graduate, and trade school. Military Benefits and Financial Aid · VA Education and Training website (link is external). Yale Scholarship. Yale's need-based grant aid for undergraduates. Scholarships, grants, and fellowship funds are forms of financial aid you do not have to pay back. These types of aid are available from various organizations. itdev-studio.ru: Search scholarships from nearly 3, sources, potentially worth up to $3 billion. itdev-studio.ru: Search for scholarships and grants. Scholarships and Grants. ACE Grant · Dual Enrollment · GCCG · GTEG · HERO · HSE Examination Grant · IPSE · Public Safety Memorial Grant · REACH Georgia · UNG. Get matched with college scholarships instantly and apply online with a common app for students and tools for counselors and providers. Renewal of the Agnes Jones Jackson Scholarship is competitive. Please refer to the NAACP National Website or call the NAACP National Education. Grand Canyon University offers generous scholarships and grant opportunities for both traditional and online students to help you finance your education. Scholarship and Grant Overview. Scholarships Graphic 1 Scholarships Graphics 2. Detailed South Carolina Scholarship and Grant Information. Palmetto Fellows.

1 2 3 4 5 6 7