itdev-studio.ru Gainers & Losers

Gainers & Losers

What Should My Student Loan Payment Be

Currently the Undergraduate Federal Stafford Loan has a fixed interest rate of % (a record low) and the Federal PLUS loan has a fixed rate of %. If you are a student with a plan 1, 2, 4, 5 or postgraduate student loan, you only make repayments if your pre-tax salary is above the repayment threshold. Your. Under the Standard Repayment Plan, you'll make fixed monthly payments of at least $50 for a period of up to 10 years for all loan types except Direct. Remember, your IBR payment would be somewhere between 10% (if you're a new borrower) to 15% of your discretionary income, divided into 12 monthly installments. SmartAsset's student loan payoff calculator shows what your monthly loan payments will look like and how your loans will amortize over time. Student loan payments cost between $ and $ on average, but that figure can vary significantly. Here's how to estimate your future student loan. Use our student loan calculator to help you estimate your payments and interest. Create a repayment plan to ensure you repay your student loans on time. SAVE Plan. 5% for undergraduate-only borrowers. Borrowers with any graduate loans will pay a weighted average of between 5% and 10%. 20 for only undergraduate. Your student loan payments should only make up a small percentage of your income, or less than 10% of your gross pay. Currently the Undergraduate Federal Stafford Loan has a fixed interest rate of % (a record low) and the Federal PLUS loan has a fixed rate of %. If you are a student with a plan 1, 2, 4, 5 or postgraduate student loan, you only make repayments if your pre-tax salary is above the repayment threshold. Your. Under the Standard Repayment Plan, you'll make fixed monthly payments of at least $50 for a period of up to 10 years for all loan types except Direct. Remember, your IBR payment would be somewhere between 10% (if you're a new borrower) to 15% of your discretionary income, divided into 12 monthly installments. SmartAsset's student loan payoff calculator shows what your monthly loan payments will look like and how your loans will amortize over time. Student loan payments cost between $ and $ on average, but that figure can vary significantly. Here's how to estimate your future student loan. Use our student loan calculator to help you estimate your payments and interest. Create a repayment plan to ensure you repay your student loans on time. SAVE Plan. 5% for undergraduate-only borrowers. Borrowers with any graduate loans will pay a weighted average of between 5% and 10%. 20 for only undergraduate. Your student loan payments should only make up a small percentage of your income, or less than 10% of your gross pay.

Your first payment was due in October or November · Your monthly payment amount depends on what repayment plan you choose. · You'll receive your monthly. Pay As You Earn (PAYE): 10% of your monthly discretionary income, as long as it does not exceed the standard loan payment amount; Income-Based Repayment (IBR). LendKey private student loans require either a $25 monthly Proactive Payment or a monthly Full Interest payment while the borrower is considered to be in. Pay half of your student loan payment every two weeks instead of making one full monthly payment. You will end up making an extra payment each year, saving you. Free calculator to evaluate student loans by estimating the interest cost, helping to understand the balance, and evaluating pay-off options. Loan Simulator helps you estimate monthly student loan payments and choose a loan repayment option that best meets your needs and goals. How does an Income-Driven Repayment Plan (IDR) work? Federal student loan borrowers pay a percentage of their discretionary income – 10%, 15% or A fixed interest rate that will remain the same throughout the life of the loan; · Your loan is currently in repayment; and · A minimum monthly payment amount of. If you are a student with a plan 1, 2, 4, 5 or postgraduate student loan, you only make repayments if your pre-tax salary is above the repayment threshold. Your. $/month, and that's just the standard 10 year payoff. I didn't bother with SAVE or IDR. How do payments and credit reporting work with student loans? The best way to protect your credit is to always make your payments on time and in full. When you. You'll repay 9% of your income over the lowest threshold out of the plan types you have. You'll only have a single repayment taken each time you get paid, even. The page covers: The different types of repayment plans; When you must start repaying your loan; How to make your payments; What to do if you are struggling. Interest-Only Repayment: Make interest-only payments while in school. This will reduce the total interest you pay on your loan. Deferred Repayment: Make no. Will there be a penalty for paying my student loan sooner? Please Note: This calculator is based on the recommendation that your student loan payment be no more than 8 percent of your gross earnings. Interest rate: %. Although the student loan is not forgiven, agencies may make payments to the loan holder of up to a maximum of $10, for an employee in a calendar year and a. Your first payment was due in October or November · Your monthly payment amount depends on what repayment plan you choose. · You'll receive your monthly. This student loan calculator will give you a good estimate of how much you will pay in interest for your loan, and about how much your monthly payment will. Effective Interest Rate of Your Student Loans (hide) ; , %, % ; , %, % ; , %, % ; , %, %.

Mutual Funds Or Stocks

Stock mutual funds and ETFs aim to provide long-term growth—unlike bond funds, which focus on income. In exchange for more growth potential, however. Mutual funds use money from investors to purchase stocks, bonds and other assets. You can think of them as ready-made portfolios. Learn how to decide between mutual funds, ETFs, and individual securities, and see how to narrow your options down. ETFs trade like stocks and are listed on stock exchanges and sold by broker-dealers. Mutual funds, on the other hand, are not listed on stock exchanges and can. An investment company pools the money of many people and invests it in stocks, bonds, or other securities that are selected by the fund manager to achieve the. Both include a pool of many different stocks and offer a way to diversify and protect your investments. In fact, most index funds are a type of mutual fund. Stocks offer higher returns but come with higher risk and volatility. Both mutual funds and stocks have fees and expenses that can affect investment returns. Top 25 Mutual Funds ; 4, VTSAX · Vanguard Total Stock Market Index Fund;Admiral ; 5, VMFXX · Vanguard Federal Money Market Fund;Investor ; 6, SPAXX · Fidelity. A mutual fund consists of a portfolio of stocks, bonds, or other securities and is overseen by a professional fund manager. Stock mutual funds and ETFs aim to provide long-term growth—unlike bond funds, which focus on income. In exchange for more growth potential, however. Mutual funds use money from investors to purchase stocks, bonds and other assets. You can think of them as ready-made portfolios. Learn how to decide between mutual funds, ETFs, and individual securities, and see how to narrow your options down. ETFs trade like stocks and are listed on stock exchanges and sold by broker-dealers. Mutual funds, on the other hand, are not listed on stock exchanges and can. An investment company pools the money of many people and invests it in stocks, bonds, or other securities that are selected by the fund manager to achieve the. Both include a pool of many different stocks and offer a way to diversify and protect your investments. In fact, most index funds are a type of mutual fund. Stocks offer higher returns but come with higher risk and volatility. Both mutual funds and stocks have fees and expenses that can affect investment returns. Top 25 Mutual Funds ; 4, VTSAX · Vanguard Total Stock Market Index Fund;Admiral ; 5, VMFXX · Vanguard Federal Money Market Fund;Investor ; 6, SPAXX · Fidelity. A mutual fund consists of a portfolio of stocks, bonds, or other securities and is overseen by a professional fund manager.

A mutual fund is an SEC-registered open-end investment company that pools money from many investors and invests the money in stocks, bonds, short-term money-. Mutual funds provide diversification, professional management, and tax benefits, making them a better choice for many investors. Top Mutual Funds ; CYPIX. ProFunds Consumer Disctnry Ultra Sec Inv, + ; DXQLX. Direxion Monthly NASDAQ Bull X Fund, + ; RYSIX. Stocks, Stock Options, Bonds, and Mutual Funds. Vested assets in the form of stocks, government bonds, and mutual funds are acceptable sources of funds for the. ETFs (exchange-traded funds) and mutual funds both offer exposure to a wide variety of asset classes and niche markets. A mutual fund is a managed portfolio of investments that investors can purchase shares of. Mutual fund managers pools money from many investors and invest the. 2. Denomination. Different stocks can have the same or equal value. Essentially it is a pool of money collected. ETFs. ETFs trade like stocks and are bought and sold on a stock exchange, experiencing price changes throughout the day. · Mutual Funds. Mutual fund orders are. The decision between investing in mutual funds versus stocks depends on several factors, including an individual's investment goals, risk tolerance and. The key difference between individual stocks and a mutual fund is investing in a single company versus investing in a collection. With stocks, you are putting. Unlike stocks and ETFs, mutual funds trade only once per day, after the markets close at 4 p.m. ET. If you enter a trade to buy or sell shares of a mutual fund. A mutual fund is a company that pools money from many investors and invests the money in securities such as stocks, bonds, and short-term debt. Each mutual fund has a different investment objective. Some funds invest in a particular product, such as stocks or bonds. Some focus on a particular industry. Mutual funds offer an affordable way to invest in a wide array of stocks without paying transaction fees for each stock held. Icon of people. Management. Stocks, bonds, and mutual funds are well-known and powerful components of a diversified portfolio. An index fund is an investment fund – either a mutual fund or an exchange-traded fund (ETF) – that is based on a preset basket of stocks, or index. Mutual funds and stocks both have their pros and cons, and the best investment option for you will depend on your personal financial goals, risk tolerance, and. They may also be key ingredients in your mutual funds. Putting portions of your money into different types of investments could help you in case some of them. Mutual funds are considered more beginner-friendly than investing in individual stocks. Of course, that also means you have no choice but to go through an. A mutual fund, on the other hand, combines many different assets—including individual stocks—into one grouping. They tend to be less volatile and risky than.

What Do You Need To Retire Early

By age 40, you should have accumulated three times your current income for retirement. By retirement age, it should be 10 to 12 times your income at that time. An early retirement plan should be created as soon as possible, to give you the maximum amount of time to plan ahead. This is especially the case for FIRE. Set a Savings Goal. Nailing down a savings goal is difficult enough under normal circumstances. But it's considerably more so if you want to retire early. One. While saving 50% can help you retire earlier than normal, wealth manager David Bach states on CNBC that saving even 20% can provide enough for an early. Before deciding whether or not you can afford an early retirement plan, you first need to determine how much savings you have, what your living costs in. How much should I save to retire early? As a rule of thumb, you can expect to spend around 80% of your pre-retirement income during each year of retirement. A worker can choose to retire as early as age 62, but doing so may result in a reduction of as much as 30 percent. As you're considering early retirement, don't forget Social Security. You can file for retirement benefits as early as age Or you can wait up until age To retire early, you'll probably need to start saving early. The earlier you start saving, the harder your money can work for you and the more help you'll get. By age 40, you should have accumulated three times your current income for retirement. By retirement age, it should be 10 to 12 times your income at that time. An early retirement plan should be created as soon as possible, to give you the maximum amount of time to plan ahead. This is especially the case for FIRE. Set a Savings Goal. Nailing down a savings goal is difficult enough under normal circumstances. But it's considerably more so if you want to retire early. One. While saving 50% can help you retire earlier than normal, wealth manager David Bach states on CNBC that saving even 20% can provide enough for an early. Before deciding whether or not you can afford an early retirement plan, you first need to determine how much savings you have, what your living costs in. How much should I save to retire early? As a rule of thumb, you can expect to spend around 80% of your pre-retirement income during each year of retirement. A worker can choose to retire as early as age 62, but doing so may result in a reduction of as much as 30 percent. As you're considering early retirement, don't forget Social Security. You can file for retirement benefits as early as age Or you can wait up until age To retire early, you'll probably need to start saving early. The earlier you start saving, the harder your money can work for you and the more help you'll get.

The rule of 25 states that you should save about 25 times the amount of your planned annual spending. So if you plan to spend about $75, in your first year. If you're considering retiring early, make sure you have a life insurance policy worth 20 times your annual salary, advises Christopher Liew. 1. How will my Social Security benefits be affected? · 2. Do I have a well-defined budget? · 3. How does early retirement affect my pension? · 4. What sources of. Find out if you will be entitled to benefits from your spouse's plan. For more information, request What You Should Know about Your. Retirement Plan. (See back. The first step is to look at all your possible sources of income, which might include an early retirement or severance package in addition to a pension, Social. 59½ -- This is the age when you can start withdrawing money without penalty from your pre-tax retirement accounts such as a company (k) or a traditional IRA. Here's a simple rule for calculating how much money you need to retire: at least 1x your salary at 30, 3x at 40, 6x at 50, 8x at 60, and 10x at If you are a household of six and want to earn retirement income equal to % of FPL, then you would need to amass a $, portfolio at a 4% rate of return. The total of $ million is your FIRE number, or the assets you need to retire early. Using the four per cent guideline, this amount would allow you to. You won't reach FIRE just by putting your money in the bank, even if you choose a high-yield savings account. However, that doesn't mean that you should be. Make more money. You can't save nearly as much on · Stay with your parents (or a roommate if not parents) as long as possible · Invest in tax. It turns out there are some interesting benefits to retiring early. Let's look at a few reasons why retiring early might be worth considering. To figure out what you would need, start with your desired yearly retirement income, subtract the annual amount of any pension or additional revenue stream you. Could you afford to retire ahead of schedule—and would you want to? Since the start of the COVID pandemic, labor force participation has fallen further among. It turns out there are some interesting benefits to retiring early. Let's look at a few reasons why retiring early might be worth considering. Early retirement at 40 requires significant savings, and the 4% withdrawal rule is a common guideline for calculating the required retirement fund. · Future. Fill the income gap. Because penalty-free withdrawals from your IRA don't start until age 59 ½ and Social Security is off limits until age 62, you'll need a way. The most important tip might be to start saving early and keep at it. “The biggest benefit in any savings plan is time. “You should not work a day longer than you have to, but you should not retire a day earlier than necessary. It's a delicate balance, but it's achievable if you.

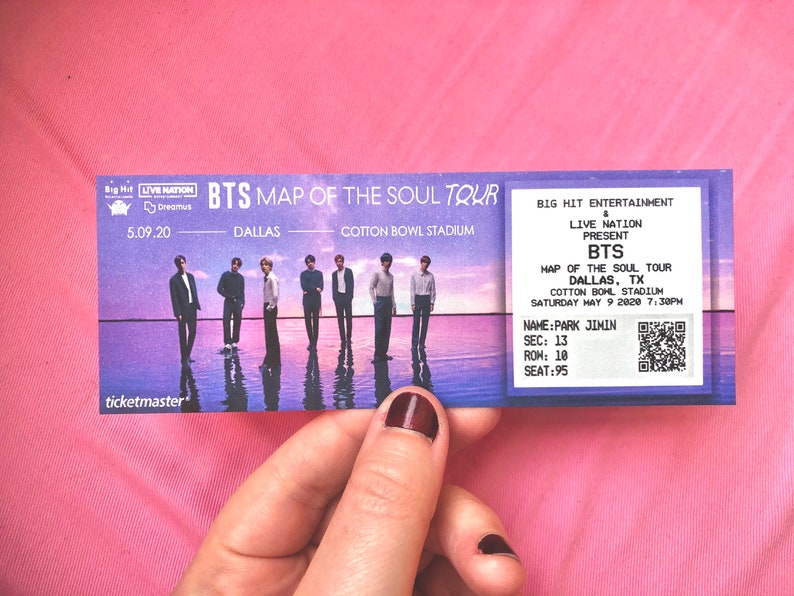

Bts Ga Tickets

Sound Check guests with GA tickets should line up with the GA line starting at the Investors Bank tower to receive their numbered wristband which secures their. New, For sale are 2 hard copy tickets to see BTS Bangtan Boys live in Concert in the General Admission Pit!! I am willing to sell these separate and am. Find BTS Atlanta tickets on SeatGeek. See BTS concerts in Atlanta and discover the best deals today. Buyer Guarantee. BTS concert and tour photos. See your seat view and get cheap BTS tickets The Novo, section: GA Floor, row: GA, seat: GA · The Novo. BTS tour: TRB itdev-studio.ru Suga Concert Experience. Suga is quickly establishing himself as a world-class solo performer as he is set to become the first BTS member to embark on a. High quality Bts Concert Ticket-inspired merch and gifts. T-shirts, posters, stickers, home decor, and more, designed and sold by independent artists around. The South Korean sensations return to Las Vegas! BTS - Bangtan Boys at the Bobby Dodd Stadium Atlanta, GA. Postponed - New date coming soon!. Buy tickets. BTS PERMISSION TO DANCE ON STAGE - LAS VEGAS is heading to Allegiant Stadium on April 15 & 16! Buy Tickets. Date: April 8 - 16, Doors Open: PM. Find the best prices on BTS tickets on SeatGeek. Discover BTS concerts, schedule, venues and more. Tickets protected by Buyer Guarantee. Sound Check guests with GA tickets should line up with the GA line starting at the Investors Bank tower to receive their numbered wristband which secures their. New, For sale are 2 hard copy tickets to see BTS Bangtan Boys live in Concert in the General Admission Pit!! I am willing to sell these separate and am. Find BTS Atlanta tickets on SeatGeek. See BTS concerts in Atlanta and discover the best deals today. Buyer Guarantee. BTS concert and tour photos. See your seat view and get cheap BTS tickets The Novo, section: GA Floor, row: GA, seat: GA · The Novo. BTS tour: TRB itdev-studio.ru Suga Concert Experience. Suga is quickly establishing himself as a world-class solo performer as he is set to become the first BTS member to embark on a. High quality Bts Concert Ticket-inspired merch and gifts. T-shirts, posters, stickers, home decor, and more, designed and sold by independent artists around. The South Korean sensations return to Las Vegas! BTS - Bangtan Boys at the Bobby Dodd Stadium Atlanta, GA. Postponed - New date coming soon!. Buy tickets. BTS PERMISSION TO DANCE ON STAGE - LAS VEGAS is heading to Allegiant Stadium on April 15 & 16! Buy Tickets. Date: April 8 - 16, Doors Open: PM. Find the best prices on BTS tickets on SeatGeek. Discover BTS concerts, schedule, venues and more. Tickets protected by Buyer Guarantee.

I applaud BTS and their team for making the decision to do seated GA (floor) so there is less of a chance of people getting hurt. Yes, Taehyung (if I can. You can get BTS - Bangtan Boys tickets from a top exchange, without the big surprise fees. Find the cheapest rates in the industry here at Ticket Club. Here for itdev-studio.ru? Click Here. BTS Tickets. Currently on sale: BTS - Onsale BTS - 9/5/18 - Staples Center - AXS Premium GA Floor. Buy Tickets · BTS - 9/6. feat. Kim Burrell, Jason Nelson, Anthony Brown, Tonya Baker, Smokie Norful, The Isaacs, and DJ Malski. Tickets. The Theatre at Capital Turnaround All Ages. Bring your ticket! · Enough money in cash! · Any official merchandise or BT21 accessories or slogan or even hand made posters and any. BTS concert and tour photos. See your seat view and get cheap BTS tickets The Novo, section: GA Floor, row: GA, seat: GA · The Novo. BTS tour: TRB itdev-studio.ru Find information on all of BTS's upcoming concerts, tour dates and ticket information for Unfortunately there are no concert dates for BTS scheduled. GA pass. My debit card auto-filled, I hit confirm, and just like that: I was going to see BTS. When BTS announced the dates for their tour in April of Tickets · General Admission · Child Yrs + Guardian · Running Low · Primary Entry · Ground Level Viewing Area · Sold Out · Viewing Platform · Sold Out. Floor seats: This means that instead of sitting on the sides and elevated you sit on the ground. Meaning you get a full view of BTS and you're close to the. The average ticket price to see BTS in concert is $, but you can get tickets starting at just $! Bobby Dodd Stadium, Atlanta, GA. Tickets. MAY Fri, TBA. BTS MetLife Stadium You are always safe and secure buying your concert tickets here with our %. Mary's, GA. Wednesday • PM. Coastal Baptist Church. Free. Motivating Sell Concert Tickets Online · Event Payment System · Solutions for Professional. Atlanta, GA, Bobby Dodd Stadium. Sat May 23, East Rutherford, NJ, MetLife BTS EUROPEAN TOUR DATES: Fri Jul 3, London, GBR, Twickenham Stadium. Sat. ARMY had been camped out for almost a week prior for a prime position in GA. In the wee hours of the morning, we Uber pooled with a young ARMY and her mother. Went here on for a BTS concert. I have a few things to say. The Citi Field staff were really nice. But the GA line could have been a bit more organized. Find tickets for BTS concerts near you. Browse tour dates, venue details, concert reviews, photos, and more at Bandsintown. All floor tickets were GA VIP soundcheck. There were no regular (non soundcheck) floor seats No there are no assigned seats. Buy BTS Atlanta concert tickets for Bobby Dodd Stadium on 5/17/ Buy with confidence. Search our huge inventory of % guaranteed BTS Bobby Dodd Stadium.

1 2 3 4